Introducing Futures Pro (v2) APIs

General

Mainnet URL: https://ascendex.com

Testnet

Testnet URL: https://api-test.ascendex-sandbox.com

You are free to register one or more accounts in the testnet. You can use the magic code 888888 to bypass all verification code checks (email verification, phone number verification, two-step authentication, etc.).

You accounts will automatically receive initial funding.

Please expect the testnet to be reset every a few days.

Obtain API Keys

Prior to use API, you need to login the website to create API Key with proper permissions. The API key is shared for all instruments in AscendEx including cash, margin and futures.

You can create and manage your API Keys here.

Every user can create up to 10 API Keys, each can be applied with either permission below:

- View permission: It is used to query the data, such as order query, trade query.

- Trade permission: It is used to place order, cancel order and transfer, etc.

- Transfer permission: It is used to create/cancel asset transfer order, etc.

Please remember below information after creation:

- Access Key is used in API request

- Secret Key is used to generate the signature (only visible once after creation)

- The API Key can bind maximum 20 IP addresses (either host IP or network IP), we strongly suggest you bind IP address for security purpose. The API Key without IP binding will be expired after 90 days.

SDKs and Client Libraries

Official SDK

CCXT is our authorized SDK provider and you may access the AscendEX API through CCXT. For more information, please visit: https://ccxt.trade

Demo Code

Python Demo: https://github.com/ascendex/ascendex-futures-api-demo-v2

Market Making Incentive Program

AscendEX offers a Market Making Incentive Program for professional liquidity providers. Key benefits of this program include:

- Favorable fee structure.

- Monthly bonus pending satisfying KPI.

- Direct Market Access and Co-location service.

Users with good maker strategies and significant trading volume are welcome to participate in this long-term program. If your account has a trading volume of more than 150,000,000 USDT in the last 30 days on any exchange, please send the following information via email to institution@ascendex.com, with the subject "Market Maker Incentive Application":

- One AscendEX account ID.

- A brief explanation of your market making method (NO detail is needed), as well as estimation of maker orders' percentage.

Got Questions?

Join our official telegram channel: https://t.me/AscendEX_Official_API

Change Log

2022-08-16

Funding Payment History added to get account funding payment history.

2022-05-19

Limit Info API is deprecated, use Limit Info API v2 to get ban info and message threshold info.

2022-02-28

- Added the Limit Info API to get ban info and risk limit info.

2021-11-22

- Added the ticker API for futures contracts.

- Added the VIP fee schedule API and the Fee Schedule by Symbol API.

2021-03-18

- Added WebSocket Query Open Orders API.

2021-03-03

- Fixed bug of cancelling a filled order with empty fields error response.

- Added symbol to error response from WebSocket Place Order.

- Updated nextFundingTime value in RESTful Futures Pricing Data response.

- Updated nextFundingTime f value in WebSocket Futures Pricing Data message.

- Added error response demo in Place New Order.

- Added error response demo in Place Batch Orders.

- Fixed bug in Cancel All Open Orders when no data is passed in request body.

- Fixed bug of URL Not Found in Account Info.

- Added openInterest in Futures Pricing Data

- Added oi (open interest) in Channel: Futures Pricing Data

2021-02-26

- Updated respInst field requirement in Place Batch Orders.

- Updated respInst field explanation in Place New Order.

2021-02-25

- Updated id field requirement in WebSocket Place Order request.

2021-02-23

- Removed collapseDecimals field from Futures Contracts Info response.

2021-02-22

- Added RESTful Current Order History API.

2021-02-21

- Added Order Id Generate Algorithm.

- Added RESTful Place Batch Orders API.

- Added RESTful Cancel Batch Orders API.

- Added RESTful Query Order By ID API.

2021-02-19

- Added WebSocket Account Snapshot API.

- Added WebSocket Place Order API.

- Added WebSocket Cancel Order API.

- Added WebSocket Cancel All Orders API.

2021-02-18

- Replaced

baseAssetandquoteAssetwithsettlementAssetin Futures Contract Info response. - Updated Account Info API path.

Futures Trading System Specification

Contract Position Notional (CPN)

- CPN = abs(position size * mark price) for the contract

CPN is defined for each contract.

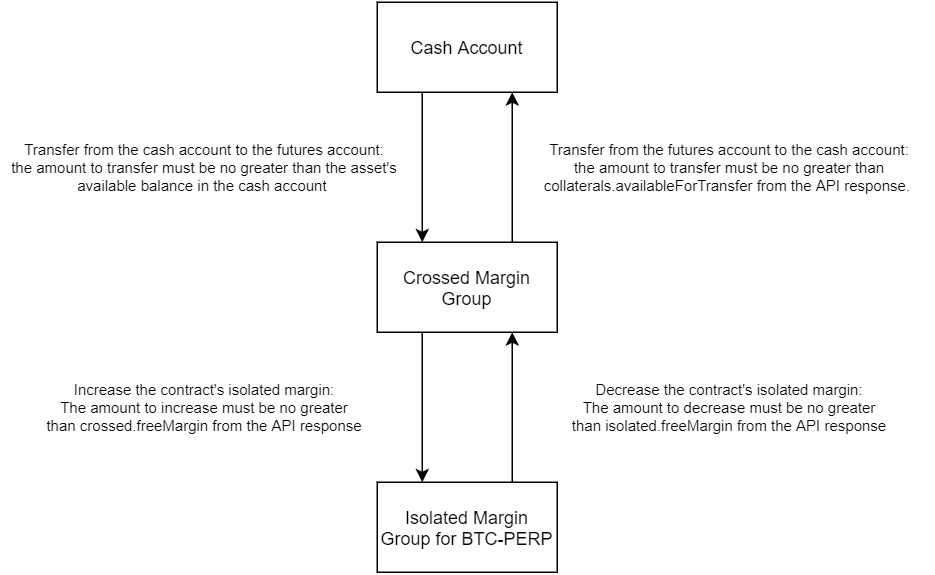

Margin Group

The Isolated Group

The isolated group manages a single position with a certain amount of margin moved out of the crossed group. It isolates the risk of the position from other margin groups. Your maximum loss will be limited to the total margin moved into the isolated group.

Each account may have at most one isolated group per contract.

The Crossed Group

The crossed group manages all positions except those in isolated groups.

Total Margin

For the isolated group

Total margin is set by the user. You can find its value in the isolatedMargin field from the Position endpoint.

You can increase / decrease the total margin of the isolated margin group via the Change Margin endpoint.

For the isolated group, we also refer to total margin as isolated margin.

For the crossed group

- Total Margin = sum(Asset Balance * Reference Price * Collateral Discount Factor) for each collateral asset

Discount factor can be found in the discountFactor field from the Futures Collateral Asset Info endpoint.

Group Collateral Balance

For the isolated group

- Group Collateral Balance = isolated margin + unrealized pnl of the isolated position

For the crossed group

- Group Collateral Balance = total margin of the crossed group + total unrealized pnl of all positions in the crossed group

The Group Collateral Balance is important to determine the risk level of the margin group. If it becomes lower than the position maintanence margin, all positions in the margin group are expected to be liquidated.

Position Initial/Maintenance Margin Rate

Initial/Maintenance Margin Rate is system-specified for each position bracket and each contract. You may refer to the marginRequirements

section from the Futures Contract Info endpoint for position brackets.

You should compare Contract Position Notional (CPN) with each position bracket to determine your initial and maintenance margin rate.

Position Initial/Maintenance Margin

For the isolated group

- Position Initial Margin = CPN * Initial Margin Rate

- Position Maintenance Margin = CPN * Maintenance Margin

For the crossed group

- Position Initial Margin = sum(CPN * Initial Margin Rate) for each contract in the crossed group

- Position Maintenance Margin = sum(CPN * Maintenance Margin Rate) for each contract in the crossed group

Liquidation Price

- V = Total Margin + Unrealized Pnl - Maintenance Margin

For long positions

- R = abs(position size) * (1 - maintenance margin rate)

- Liquidation Price = mark price - V / R

If the calculated liquidation price is negative, the position won't be liquidation even when the price becomes zero.

For short positions

- R = abs(position size) * (1 + maintenance margin rate)

- Liquidation Price = mark price + V / R

Unrealized PnL

The Unrealized PnL of a position is calculated as:

- Unrealized PnL = mark price * position + reference cost

Note that position and reference cost are of opposite signs.

The Unrealized PnL will be rolled (settled) when:

- position is closed or flipped side (long becomes short, vice versa)

- every 15 minutes AND abs(Unrealized Pnl) >= 10 USDT

Assume your current position is P, the current reference cost if RC, and unrealized PnL is L, after rolling:

- position = P

- reference cost = RC + L

- realized PnL = 0

You should always include the unrealized PnL when calculating the collateral balance.

Realized PnL

Realized Pnl is merely a bookkeeping entry for all profits and losses realized by the current position under the assumption that the position was built on an average cost basis.

If you are mostly concerned about the risk of your positions, you can ignore the realized PnL.

RESTful APIs

Exchange Latency Info

Latency Info

curl -X GET https://ascendex.com/api/pro/v1/exchange-info?requestTime="$(date +%s%N | cut -b1-13)"

Latency Info - Sample response::

{

"code": 0,

"data":

{

"requestTimeEcho": 1640052379050,

"requestReceiveAt": 1640052379063,

"latency": 13

}

}

HTTP Request

GET /api/pro/v1/exchange-info

Request Parameters

| Name | Type | Required | Value Range | Description |

|---|---|---|---|---|

| requestTime | Long | Yes | milliseconds since UNIX epoch in UTC | the client's local time. The server compare it with the system time to calculate latency. |

General Info (Public)

Futures Contracts Info

Response - Futures Contracts Info

{

"code": 0,

"data": [

{

"symbol" : "BTC-PERP",

"status" : "Normal",

"displayName" : "BTCUSDT", // the name displayed on the webpage

"settlementAsset" : "USDT", // settlement asset

"underlying" : "BTC/USDT",

"tradingStartTime": 1579701600000,

"priceFilter": {

"minPrice" : "0.25", // the order price cannot be smaller than the minPrice

"maxPrice" : "1000000", // the order price cannot be greater than the maxPrice

"tickSize" : "0.25" // the order price must be a multiple of the tickSize

},

"lotSizeFilter": {

"minQty" : "0.0001", // the order quantity cannot be smaller than the minQty

"maxQty" : "1000000000", // the order quantity cannot be greater than the maxQty

"lotSize" : "0.0001" // the order quantity must be a multiple of the lotSize

},

"marginRequirements": [

{

"positionNotionalLowerbound": "0", // position lower bound

"positionNotionalUpperbound": "50000", // position upper bound

"initialMarginRate" : "0.01", // initial margin rate

"maintenanceMarginRate" : "0.006" // maintenance margin rate

},

{

"positionNotionalLowerbound": "50000",

"positionNotionalUpperbound": "200000",

"initialMarginRate" : "0.02",

"maintenanceMarginRate" : "0.012"

}

]

}

]

}

Get information for all futures contracts.

HTTP Request

GET /api/pro/v2/futures/contract

Response

Futures Collateral Asset Info

Response - Futures Collateral Asset Info

{

"code": 0,

"data": [

{

"asset" : "BTC",

"assetName" : "Bitcoin",

"conversionFactor": "0.995",

"discountFactor" : "0.98",

"displayName" : "BTC",

"statusCode" : "Normal"

},

{

"asset" : "USDT",

"assetName" : "Tether",

"conversionFactor": "1",

"discountFactor" : "1",

"displayName" : "USDT",

"statusCode" : "Normal"

},

{

"asset" : "USDTR",

"assetName" : "Futures Reward Token",

"conversionFactor": "1",

"discountFactor" : "1",

"displayName" : "USDTR",

"statusCode" : "NoTransaction"

}

]

}

Get information for all futures collateral assets.

HTTP Request

GET /api/pro/v2/futures/collateral

Market Data (Public)

Anyone can access public market data via the API endpoints. No authentication is needed.

Futures Pricing Data

Requesting pricing data for all futures contract

{

"code": 0,

"data": {

"contracts": [

{

"symbol" : "BTC-PERP", // contract symbol

"time" : 1614815005717, // server time (UTC timestamp in milliseconds)

"fundingRate" : "0.000564448", // funding rate

"indexPrice" : "50657.35", // index price of the underlying

"markPrice" : "50667.130409723", // mark price of the contract

"openInterest" : "90.7366", // funding rate

"nextFundingTime": 1614816000000 // next funding time (UTC timestamp in milliseconds)

}

],

"collaterals": [

{

"asset": "USDTR",

"referencePrice": "1"

},

{

"asset": "USDC",

"referencePrice": "0.9994"

},

{

"asset": "ETH",

"referencePrice": "1582.3264074"

},

{

"asset": "PAX",

"referencePrice": "0.99645"

},

{

"asset": "BTC",

"referencePrice": "50636.14"

},

{

"asset": "USDT",

"referencePrice": "1"

}

],

}

}

Get pricing data for all futures contracts.

HTTP Request

GET /api/pro/v2/futures/pricing-data

Bar Info

Request

curl -X GET "https://ascendex.com/api/pro/v1/barhist/info"

Sample response

{

"code": 0,

"data": [

{

"name": "1",

"intervalInMillis": 60000

},

{

"name": "5",

"intervalInMillis": 300000

},

{

"name": "15",

"intervalInMillis": 900000

},

{

"name": "30",

"intervalInMillis": 1800000

},

{

"name": "60",

"intervalInMillis": 3600000

},

{

"name": "120",

"intervalInMillis": 7200000

},

{

"name": "240",

"intervalInMillis": 14400000

},

{

"name": "360",

"intervalInMillis": 21600000

},

{

"name": "720",

"intervalInMillis": 43200000

},

{

"name": "1d",

"intervalInMillis": 86400000

},

{

"name": "1w",

"intervalInMillis": 604800000

},

{

"name": "1m",

"intervalInMillis": 2592000000

}

]

}

HTTP Request

GET /api/pro/v1/barhist/info

This API returns a list of all bar intervals supported by the server.

Request Parameters

This API endpoint does not take any parameters.

Resposne

| Name | Type | Description |

|---|---|---|

name |

String |

name of the interval |

intervalInMillis |

Long |

length of the interval |

Plesae note that the one-month bar (1m) always resets at the month start. The intervalInMillis value for the one-month bar is only indicative.

The value in the name field should be your input to the Historical Bar Data API.

Historical Bar Data

Request

curl -X GET "https://ascendex.com/api/pro/v1/barhist?symbol=BTC-PERP&interval=1"

Sample response

{

"code": 0,

"data":

[

{

"m": "bar",

"s": "BTC-PERP",

"data":

{

"i": "1",

"ts": 1637619240000,

"o": "56263",

"c": "56260",

"h": "56263",

"l": "56239",

"v": "0.0126"

}

},

{

"m": "bar",

"s": "BTC-PERP",

"data":

{

"i": "1",

"ts": 1637619300000,

"o": "56243",

"c": "56243",

"h": "56243",

"l": "56243",

"v": "0.0001"

}

}

]

}

HTTP Request

GET /api/pro/v1/barhist

This API returns a list of bars, with each contains the open/close/high/low prices of a symbol for a specific time range.

Request Parameters

| Name | Type | Required | Description |

|---|---|---|---|

symbol |

String |

Yes | e.g. "BTC-PERP" |

interval |

String |

Yes | a string representing the interval type. |

to |

Long |

No | UTC timestamp in milliseconds. If not provided, this field will be set to the current time. |

from |

Long |

No | UTC timestamp in milliseconds. |

n |

Int |

No | default 10, number of bars to be returned, this number will be capped at 500 |

The requested time range is determined by three parameters - to, from, and n - according to rules below:

from/toeach specifies the start timestamp of the first/last bar.tois always honored. If not provided, this field will be set to the current system time.- For

fromandto:- if only

fromis provided, then the request range is determined by[from, to], inclusive. However, if the range is too wide, the server will increasefromso the number of bars in the response won't exceed 500. - if only

nis provided, then the server will return the most recentndata bars to timeto. However, ifnis greater than 500, only 500 bars will be returned. - if both

fromandnare specified, the server will pick one that returns fewer bars.

- if only

Response

| Name | Type | value | Description |

|---|---|---|---|

m |

String | bar |

message type |

s |

String | symbol | |

data:ts |

Long | bar start time in milliseconds | |

i |

String | interval | |

o |

String | open price | |

c |

String | close price | |

h |

String | high price | |

l |

String | low price | |

v |

String | volume in quote asset |

Code Sample

Please refer python code to [get bar history]{https://github.com/ascendex/ascendex-pro-api-demo/blob/main/python/query_pub_barhist.py}

Ticker

Ticker for one trading pair

// curl -X GET 'https://ascendex.com/api/pro/v2/futures/ticker?symbol=BTC-PERP'

{

"code": 0,

"data":

{

"symbol": "BTC-PERP",

"open": "59488",

"close": "56725",

"high": "59724",

"low": "56672",

"baseVol": "208.7414",

"ask":

[

"56730",

"0.0005"

],

"bid":

[

"56710",

"0.0042"

]

}

}

List of Tickers for one or multiple trading pairs

// curl -X GET "https://ascendex.com/api/pro/v2/futures/ticker?symbol=BTC-PERP,"

{

"code": 0,

"data":

[

{

"symbol": "BTC-PERP",

"open": "59488",

"close": "56716",

"high": "59724",

"low": "56672",

"baseVol": "208.7414",

"ask":

[

"56720",

"0.2315"

],

"bid":

[

"56712",

"0.0024"

]

}

]

}

HTTP Request

GET api/pro/v2/futures/ticker

You can get summary statistics of one or multiple symbols (spot market) with this API.

Request Parameters

| Name | Type | Required | Value Range | Description |

|---|---|---|---|---|

symbol |

String |

No | you may specify one, multiple, or all symbols of interest. See below. |

This API endpoint accepts one optional string field symbol:

- If you do not specify

symbol, the API will responde with tickers of all symbols in a list. - If you set

symbolto be a single symbol, such asASD/USDT, the API will respond with the ticker of the target symbol as an object. If you want to wrap the object in a one-element list, append a comma to the symbol, e.g.ASD/USDT,. - You shall specify

symbolas a comma separated symbol list, e.g.ASD/USDT,BTC/USDT. The API will respond with a list of tickers.

Respond Content

The API will respond with a ticker object or a list of ticker objects, depending on how you set the symbol parameter.

Each ticker object contains the following fields:

| Field | Type | Description |

|---|---|---|

symbol |

String |

|

open |

String |

the traded price 24 hour ago |

close |

String |

the last traded price |

high |

String |

the highest price over the past 24 hours |

low |

String |

the lowest price over the past 24 hours |

volume |

String |

the total traded volume in quote asset over the paste 24 hours |

ask |

[String, String] |

the price and size at the current best ask level |

bid |

[String, String] |

the price and size at the current best bid level |

Code Sample

Please refer to python code to [query ticker info]{https://github.com/ascendex/ascendex-pro-api-demo/blob/main/python/query_pub_ticker.py}

Authenticate a RESTful Request

Create Request

To access private data via RESTful APIs, you must include the following headers:

x-auth-key- required, the api key as a string.x-auth-timestamp- required, the UTC timestamp in milliseconds of your requestx-auth-signature- required, the request signature (see Sign a Request)

The timestamp in the header will be checked against server time. If the difference is greater than 30 seconds, the request will be rejected.

Sign a Request

Signing a RESTful Request

# bash

APIPATH=info

APIKEY=CEcrjGyipqt0OflgdQQSRGdrDXdDUY2x

SECRET=hV8FgjyJtpvVeAcMAgzgAFQCN36wmbWuN7o3WPcYcYhFd8qvE43gzFGVsFcCqMNk

TIMESTAMP=`date +%s%N | cut -c -13` # 1608133910000

MESSAGE=$TIMESTAMP+$APIPATH

SIGNATURE=`echo -n $MESSAGE | openssl dgst -sha256 -hmac $SECRET -binary | base64`

echo $SIGNATURE # /pwaAgWZQ1Xd/J4yZ4ReHSPQxd3ORP/YR8TvAttqqYM=

curl -X GET -i \

-H "Accept: application/json" \

-H "Content-Type: application/json" \

-H "x-auth-key: $APIKEY" \

-H "x-auth-signature: $SIGNATURE" \

-H "x-auth-timestamp: $TIMESTAMP" \

https://ascendex.com/api/pro/v1/info

# python 3.6+

import time, hmac, hashlib, base64

api_path = "info"

api_key = "CEcrjGyipqt0OflgdQQSRGdrDXdDUY2x"

sec_key = "hV8FgjyJtpvVeAcMAgzgAFQCN36wmbWuN7o3WPcYcYhFd8qvE43gzFGVsFcCqMNk"

timestamp = int(round(time.time() * 1e3)) # 1608133910000

message = bytes(f"{timestamp}+{api_path}", 'utf-8')

secret = bytes(sec_key, 'utf-8')

signature = base64.b64encode(hmac.new(secret, message, digestmod=hashlib.sha256).digest())

header = {

"x-auth-key": api_key,

"x-auth-signature": signature,

"x-auth-timestamp": timestamp,

}

print(signature) # b'/pwaAgWZQ1Xd/J4yZ4ReHSPQxd3ORP/YR8TvAttqqYM='

// java 1.8+

import javax.crypto.Mac;

import javax.crypto.spec.SecretKeySpec;

import org.apache.commons.codec.binary.Base64;

public class SignatureExample {

public static void main(String[] args) {

try {

long timestamp = System.currentTimeMillis(); // 1562952827927

String api_path = "user/info";

String secret = "hV8FgjyJtpvVeAcMAgzgAFQCN36wmbWuN7o3WPcYcYhFd8qvE43gzFGVsFcCqMNk";

String message = timestamp + "+" + api_path;

Mac sha256_HMAC = Mac.getInstance("HmacSHA256");

SecretKeySpec secret_key = new SecretKeySpec(secret.getBytes(), "HmacSHA256");

sha256_HMAC.init(secret_key);

String hash = Base64.encodeBase64String(sha256_HMAC.doFinal(message.getBytes()));

System.out.println(hash); // vBZf8OQuiTJIVbNpNHGY3zcUsK5gJpwb5lgCgarpxYI=

}

catch (Exception e) {

System.out.println("Error");

}

}

}

To query APIs with private data, you must include a signature using base64 encoded HMAC sha256 algorithm. The prehash string is <timestamp>+<api-path>.

The timestamp is the UTC timestamp in milliseconds. The api-path is provided in each API description.

See the code demos in (bash/python/java) on the right.

Account Data

Account Info

Account Info - Sample response:

{

"code": 0,

"data": {

"accountGroup": 0,

"email": "yyzzxxz@gmail.com",

"expireTime": 1604620800000, // expire time, UTC timestamp in milliseconds. If -1, the api key will not expire

"allowedIps": ["123.123.123.123"],

"cashAccount": [

"sample-cash-account-id"

],

"marginAccount": [

"sample-margin-account-id"

],

"futuresAccount": [

"sample-futures-account-id"

],

"userUID": "U0866943712",

"tradePermission": true,

"transferPermission": true,

"viewPermission": true,

"limitQuota": 1000

}

}

HTTP Request

GET /api/pro/v2/account/info

Signature

You should sign the message in header as specified in Authenticate a RESTful Request section.

prehash string

<timestamp>+v2/account/info

Obtain the account information.

You can obtain your accountGroup from this API, which you will need to include in the URL for all your private RESTful requests.

Response Content

| Name | Type | Description |

|---|---|---|

| accountGroup | Int | non-negative integer |

| String | ||

| expireTime | Long | the time when the API key will be expired (UTC timestamp in milliseconds). If -1, the api key will not expire |

| allowedIps | List[String] | list of IPs allowed for the api key |

| cashAccount | List[String] | |

| marginAccount | List[String] | |

| tradePermission | Boolean | |

| transferPermission | Boolean | |

| viewPermission | Boolean | |

| userUID | String | an unique id associated with user |

See a demo at query private account info.

VIP Fee Schedule

Fee Schedule - Sample response for general info::

{

"code": 0,

"data":

{

"domain": "futures",

"userUID": "U0866943712",

"vipLevel": 0,

"genericFee":

{

"largeCap":

{

"maker": "0.00085",

"taker": "0.00085"

},

"smallCap":

{

"maker": "0.001",

"taker": "0.001"

}

}

}

}

HTTP Request

GET <account-group>/api/pro/v1/futures/fee/info

Signature

You should sign the message in header as specified in Authenticate a RESTful Request section.

prehash string

<timestamp>+fee/info

See a demo at query fee.

Fee Schedule by Symbol

Fee Schedule - Sample response for each symbol::

{

"code": 0,

"data":

{

"domain": "futures",

"userUID": "U0866943712",

"vipLevel": 0,

"productFee":

[

{

"fee":

{

"maker": "0.0001",

"taker": "0.0001"

},

"symbol": "BTC-PERP"

},

{

"fee":

{

"maker": "0.0001",

"taker": "0.0001"

},

"symbol": "ETH-PERP"

}

]

}

}

HTTP Request

GET <account-group>/api/pro/v1/futures/fee

Signature

You should sign the message in header as specified in Authenticate a RESTful Request section.

prehash string

<timestamp>+fee

See a demo at query fee.

Risk Limit Info(Deprecated)

This API has been deprecated, please use risk limit info v2 instead.

Risk Limit Info

curl -X GET https://ascendex.com/api/pro/v1/risk-limit-info"

Risk Limit Info - Sample response::

{

"code": 0,

"data": {

"ip": "0.0.0.0",

"webSocket": {

"windowSizeInMinutes": 5,

"maxNumRequests": 45,

"maxSessionPerIp": 30,

"isBanned": true,

"bannedUntil": 1644807691158,

"violationCode": 100014,

"reason": "exceeds MAX_REQ_COUNT_PER_IP[45], 49 requests recently"

}

}

}

HTTP Request

GET /api/pro/v1/risk-limit-info

Request Parameters

| Name | Type | Required | Value Range | Description |

|---|---|---|---|---|

| ip | String | No | valid ip address | the client's ip address to be checked if it is banned due to violation of risk limits. |

Risk Limit Info (v2)

Risk Limit Info v2

Our message thresholds in web socket are based on op field and action field. Each threshold will have two levels, which are based on counts of messages received in 1 minute. If level 1 threshold is violated, this type of messages will be ignored in the following 15 minutes, other functions are not affected. If you keep sending these messages and triggered level 2 threshold, the violated WebSocket session will be killed and this ip will be banned for 15 minutes. Currently, We have following threshold groups:

admin op, includesauth/ping/pongstream op, includessub/unsubreq op, includes allreqop, butorder reqandsnapshot reqhave their own thresholdsorder req, includesplace_order/cancel_order/cancel_allsnapshot req, includesdepth_snapshot/depth_snapshot_top100

All the operations fall into same op/req group will share a threshold, meaning the sum of count of these messages should not violate the threshold.

For req op, we have two fine granularity threshold order req and snapshot req, which will have their specialized threshold value for messages belonging to their types.

curl -X GET https://ascendex.com/api/pro/v2/risk-limit-info"

Risk Limit Info - Sample response::

{

"code": 0,

"data": {

"ip": "173.123.133.23",

"webSocket": {

"status": {

"isBanned": false,

"bannedUntil": -1,

"violationCode": 0,

"reason": ""

},

"limits": {

"maxWebSocketSessionsPerIpAccountGroup": 20,

"maxWebSocketSessionsPerIpTotal": 300

},

"messageThreshold": {

"level1OpThreshold": {

"auth": 800,

"ping": 800,

"pong": 800,

"sub": 150,

"unsub": 150,

"req": 10000

},

"level2OpThreshold": {

"auth": 1000,

"ping": 1000,

"pong": 1000,

"sub": 200,

"unsub": 200,

"req": 10000

},

"level1ReqThreshold": {

"place_order": 8000,

"cancel_order": 8000,

"cancel_all": 8000,

"batch_place_order": 10000,

"batch_cancel_order": 10000,

"depth_snapshot": 400,

"depth_snapshot_top100": 400,

"market_trades": 10000,

"balance": 10000,

"open_order": 10000,

"margin_risk": 10000,

"futures_account_snapshot": 10000,

"futures_open_orders": 10000

},

"level2ReqThreshold": {

"place_order": 10000,

"cancel_order": 10000,

"cancel_all": 10000,

"batch_place_order": 10000,

"batch_cancel_order": 10000,

"depth_snapshot": 500,

"depth_snapshot_top100": 500,

"market_trades": 10000,

"balance": 10000,

"open_order": 10000,

"margin_risk": 10000,

"futures_account_snapshot": 10000,

"futures_open_orders": 10000

}

}

}

}

}

HTTP Request

GET /api/pro/v2/risk-limit-info

Request Parameters

| Name | Type | Required | Value Range | Description |

|---|---|---|---|---|

| ip | String | No | valid ip address | the client's ip address to be checked if it is banned due to violation of risk limits. |

Position

Response

{

"code": 0,

"data": {

"ac" : "FUTURES", // account category

"accountId" : "sample-futures-account-id", // account ID

"collaterals": [

{

"asset" : "ETH", // collateral asset

"balance" : "100", // balance

"discountFactor": "0.95", // discount factor

"referencePrice": "481.79793092" // reference price (quote in USDT)

},

{

"asset" : "BTC",

"balance" : "10",

"discountFactor": "0.98",

"referencePrice": "17600.095"

},

{

"asset" : "USDT",

"balance" : "10000",

"discountFactor": "1",

"referencePrice": "1"

}

],

"contracts": [

{

"symbol" : "BTC-PERP", // contract symbol

"side" : "LONG", // side

"position" : "0.5", // positive for long position and negative for short position

"referenceCost" : "-16800", // reference cost

"unrealizedPnl" : "0", // unrealized pnl

"realizedPnl" : "0", // realized pnl

"avgOpenPrice" : "0", // Average Opening Price

"marginType" : "cross", // margin type: isolated / cross

"isolatedMargin" : "0", // isolated margin

"leverage" : "10", // leverage

"takeProfitPrice" : "0", // take profit price (by position exit order)

"takeProfitTrigger" : "market", // take profit trigger (by position exit order)

"stopLossPrice" : "0", // stop loss price (by position exit order)

"stopLossTrigger" : "market", // stop loss trigger (by position exit order)

"buyOpenOrderNotional" : "1362.419625", // buy open order notional

"sellOpenOrderNotional": "0", // sell open order notional

"indexPrice" : "17600.095", // price of the contract's underlying product price

"markPrice" : "-1" // contract's mark price

}

]

}

}

Get current position data - a full snapshot of your futures account.

HTTP Request

GET /<grp>/api/pro/v2/futures/position

Prehash String

<timestamp>+v2/futures/position

Free Margin

Response

{

"code": 0,

"data": {

"collaterals": [

{

"asset": "BTC", // collateral asset

"availableForTransfer": "1" // maximum amount allowed to be transferred out

},

{

"asset": "USDT",

"availableForTransfer": "10000"

}

],

"crossed": {

"freeMargin": "30000"

},

"isolated": [

{

"freeMargin": "0",

"symbol": "BTC-PERP"

}

]

}

}

Get free margin for each margin group (crossed & isolated) and amount avaible for withdrawal for each collateral asset.

See Change Margin on how to increase or decrease margin for the isolated position.

HTTP Request

GET /<grp>/api/pro/v2/futures/free-margin

Prehash String

<timestamp>+v2/futures/free-margin

Change Margin (for Isolated Positions)

Successful Response

{

"code": 0

}

You can only change margin for isolated margin positions.

See Free Margin on the maximum amount you can increase / decrease the isolated margin.

HTTP Request

POST /<grp>/api/pro/v2/futures/isolated-position-margin

Prehash String

<timestamp>+v2/futures/isolated-position-margin

Request Parameters

| PARAMETER | TYPE | REQUIRED | DESCRIPTION |

|---|---|---|---|

| symbol | String | Yes | e.g. BTC-PERP |

| amount | String | Yes | margin amount in string type, e.g. "100". Set amount to positive will increase the isolated margin; set amount |

to a negative number will decrease the isolated margin.

When you increase/decrease the isolated margin by a certain amount, the same amount X will be deducted/added from your USDT balance in the collateral.

When you have non-USDT collateral assets, you may be able to increase the isolated margin by an amount more than your USDT balance. In which case, your USDT balance will become negative after the operation.

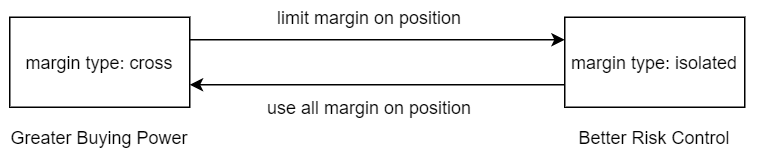

Change Margin Type

Response

{

"code": 0

}

You can change the margin type of a position:

- crossed margin (

crossed) - isolated margin (

isolated)

HTTP Request

POST /<grp>/api/pro/v2/futures/margin-type

Prehash String

<timestamp>+v2/futures/margin-type

Request Parameters

| PARAMETER | TYPE | REQUIRED | DESCRIPTION |

|---|---|---|---|

| symbol | String | Yes | e.g. BTC-PERP |

| marginType | ENUM | Yes | You can switch between two margin types: isolated and crossed |

Change Contract Leverage

Response

{

"code": 0,

"data": {

"leverage": 10,

"symbol" : "BTC-PERP"

}

}

HTTP Request

POST /<grp>/api/pro/v2/futures/leverage

Request Parameters

| PARAMETER | TYPE | REQUIRED | DESCRIPTION |

|---|---|---|---|

| symbol | String | Yes | e.g. BTC-PERP |

| leverage | Int | Yes | the leverage should be an integer between 1 and 100 |

Deposit to the Futures Account

Successful Response

{

"code": 0

}

You can deposit collateral assets to your Futures account from your Cash account.

HTTP Request

POST /<grp>/api/pro/v2/futures/transfer/deposit

Prehash String

<timestamp>+v2/futures/transfer/deposit

Request Parameters

| PARAMETER | TYPE | REQUIRED | DESCRIPTION |

|---|---|---|---|

| asset | String | Yes | e.g. BTC |

| amount | String | Yes | the amount to deposit in string type, e.g. "1". Only positive value is allowed. |

Withdraw from the Futures Account

Successful Response

{

"code": 0

}

You can withdraw collateral assets from your Futures account to your Cash account.

HTTP Request

POST /<grp>/api/pro/v2/futures/transfer/withdraw

Prehash String

<timestamp>+v2/futures/transfer/withdraw

Request Parameters

| PARAMETER | TYPE | REQUIRED | DESCRIPTION |

|---|---|---|---|

| asset | String | Yes | e.g. BTC |

| amount | String | Yes | the amount to withdraw in string type, e.g. "1". Only positive value is allowed. |

Funding Payment History

Response

{

"code": 0,

"data": {

"data": [

{

"fundingRate": "0.00003666",

"paymentInUSDT": "-0.000142423",

"symbol": "BTC-PERP",

"timestamp": 1642780800000

},

{

"fundingRate": "0.000109429",

"paymentInUSDT": "-0.000428031",

"symbol": "BTC-PERP",

"timestamp": 1642752000000

}

],

"hasNext": true,

"page": 1,

"pageSize": 2

}

}

Get funding payment history of your account.

HTTP Request

GET /<grp>/api/pro/v2/futures/funding-payments

Prehash String

<timestamp>+v2/futures/funding-payments

Request Parameters

| Name | Type | Required | Description |

|---|---|---|---|

symbol |

String | No | e.g. BTCUSDT |

page |

Int | No | page number, default 1 |

pageSize |

Int | No | size of the page, 1~100, default 20. |

Code Sample

Please refer to python code to get funding history

Order

Generate Order Id

We use the following method to generate an unique id for each order place/cancel request. (You could get userUID from Account Info API.)

Method

A = 'a' for order via rest api, or 's' for order via websocket;

B = Convert timestamp (in miliseconds) to hex string;

C = User UID (11 chars, starting with 'U' followed by 10 digits);

D = If user provide client order Id (with length >= 9, letters and digits only), then take the right 9 chars; otherwise, we randomly generate 9 chars;

Final order Id is concatenation of strings A, B, C, D from above steps, i.e., orderId = A + B + C + D.

Extra info on id

idvalue must satisfy regrex pattern"^\w[\w\-]*\w$"(i.e. start and end with word character), and with length up to 32. ("Invalid Client Order id" error for violation)idvalue with length 9 is recommended, since we take the right most 9 chars for order Id generation.idvalue with length < 9 will not be used in order Id generation, but we still echo it back in order ack message (empty string when noidvalue provided).If a valid

idvalue is provided when placing order, order Id from server side is pre-determined. This could be helpful for order status check in case of accidently internet connection issue.

Code Sample

Please refer to python code to gen server order id

New Order

Successful Response

{

"code": 0,

"data": {

"meta": {

"action" : "place-order",

"id" : "abcd1234abcd1234",

"respInst": "ACCEPT" // ACK, ACCEPT, or DONE

},

"order": {

"ac" : "FUTURES",

"accountId" : "sample-futures-account-id",

"seqNum" : 14, // sequence number, also -1 in ACK mode

"time" : 1605677683714,

"orderId" : "sample-order-id",

"orderType" : "Limit",

"side" : "Buy",

"symbol" : "BTC-PERP",

"price" : "9500",

"orderQty" : "0.1",

"stopPrice" : "0",

"stopBy" : "market",

"status" : "New",

"lastExecTime": 1605677684479,

"lastPx" : "0",

"lastQty" : "0",

"avgFilledPx" : "0",

"cumFilledQty": "0",

"fee" : "0",

"cumFee" : "0",

"feeAsset" : "USDT",

"errorCode" : ""

}

}

}

Error Response

{

"ac": "FUTURES",

"accountId": "sample-futures-account-id",

"action": "place-order",

"code": 300014,

"info": {

"id": "abcd1234abcd1234",

"symbol": "BTC-PERP"

},

"message": "Order price doesn't conform to the required tick size: 1",

"reason": "TICK_SIZE_VIOLATION"

}

HTTP Request

POST /<grp>/api/pro/v2/futures/order

Prehash String

<timestamp>+v2/futures/order

Request Parameters

| PARAMETER | TYPE | REQUIRED | DESCRIPTION |

|---|---|---|---|

| id | String | >=9 chars (letter and digit number only). Optional but recommended. We echo it back to help you match response with request. By setting this field, you can obtain the orderId before sending the request. It is also useful when you place order in batch mode. | |

| time | Long | Yes | Milliseconds since UNIX epoch in UTC. We do not process request placed more than 30 seconds ago. |

| symbol | String | Yes | e.g. BTC-PERP |

| orderPrice | String | Required for Limit and StopLimit orders |

|

| orderQty | String | Yes | Order size. Please set scale properly for each symbol. |

| orderType | ENUM | Yes | |

| side | ENUM | Yes | |

| respInst | ENUM | ACK for limit order and Done for market order by default |

|

| postOnly | Boolean | false by default |

|

| stopPrice | String | required for StopLimit and StopMarket orders |

|

| timeInForce | ENUM | GTC by default |

|

| execInst | ENUM | ||

| posStopLossPrice | String | position stop loss price | |

| posTakeProfitPrice | String | position take profit price |

Place Batch Orders

Place Batch Orders - Request Body

{

"orders": [

{

"id" : "sampleRequestId1",

"time" : 1613878579169,

"symbol" : "BTC-PERP",

"price" : "34000",

"orderQty" : "0.1",

"orderType" : "limit",

"side" : "buy",

"respInst" : "ACK"

},

{

"id" : "sampleRequestId2",

"time" : 1613878579169,

"symbol" : "BTC-PERP",

"price" : "35000",

"orderQty" : "0.2",

"orderType" : "market",

"side" : "buy",

"respInst" : "ACK"

}

]

}

Place Batch Orders - Successful ACK Response (Status 200, code 0)

{

"code": 0,

"data": {

"meta": {

"action" : "batch-place-order",

"respInst": "ACK"

},

"orders": [

{

"id" : "sampleRequestId1",

"orderId" : "a177c2a8cfe1U0123456789eqntvwWsy",

"orderType": "Limit",

"symbol" : "BTC-PERP",

"timestamp": 1613878579202

},

{

"id" : "sampleRequestId2",

"orderId" : "a177c2a8cfe1U0123456789equestId2",

"orderType": "Market",

"symbol" : "BTC-PERP",

"timestamp": 1613878579202

}

]

}

}

Error Response

{

"ac": "FUTURES",

"accountId": "sample-futures-account-id",

"action": "batch-place-order",

"code": 300013,

"info": [

{

"code": 300013,

"id": "sampleRequestId1",

"message": "Some invalid order in this batch.",

"reason": "INVALID_BATCH_ORDER",

"symbol": "BTC-PERP"

},

{

"code": 320008,

"id": "sampleRequestId2",

"message": "Futures account exposure higher than system acceptable level.",

"reason": "FUTURES_TOO_RISKY",

"symbol": "BTC-PERP"

}

],

"message": "Batch Order failed, please check each order info for detail.",

"reason": "INVALID_BATCH_ORDER"

}

Place multiple orders in a batch. If any order(s) fails our basic check, the whole batch request will fail.

You may submit up to 10 orders at a time. Server will respond with error if you submit more than 10 orders.

HTTP Request

POST /<grp>/api/pro/v2/futures/order/batch

Prehash String

<timestamp>+v2/futures/order/batch

Request Parameters

| Name | Data Type | Description |

|---|---|---|

| orders | List | List of order items |

please refer to placing new order for order item definition.

respInst field is required for market order and only ACK is allowed.

Cancel Order

Response

{

"code": 0,

"data": {

"meta": {

"action" : "cancel-order", // action

"id" : "abcd1234abcd1234", // user provided ID

"respInst": "ACCEPT" // response instruction

},

"order": {

"ac" : "FUTURES", // account category

"accountId" : "sample-futures-account-id", // account ID

"seqNum" : 14, // sequence number

"time" : 1605677683714, // order creation time (UTC time in milliseconds)

"orderId" : "sample-order-id", // order ID

"orderType" : "Limit", // order type

"side" : "Buy", // side

"symbol" : "BTC-PERP", // contract symbol

"price" : "9500", // order price

"orderQty" : "0.1", // order qty

"stopPrice" : "0", // stop price

"stopBy" : "market", // stop price trigger

"status" : "Canceled", // order status

"lastExecTime": 1605677684479, // last execution time (UTC time in milliseconds)

"lastPx" : "0", // last filled price

"lastQty" : "0", // last filled quantity

"avgFilledPx" : "0", // average filled price of all fills

"cumFilledQty": "0", // cummulative filled quantity

"fee" : "0", // fee of the last fill

"cumFee" : "0", // cummulative fee

"feeAsset" : "USDT", // fee asset

"errorCode" : "" // error code

}

}

}

HTTP Request

DELETE /<grp>/api/pro/v2/futures/order

Prehash String

<timestamp>+v2/futures/order

Request Parameters

| PARAMETER | TYPE | REQUIRED | DESCRIPTION |

|---|---|---|---|

| id | String | >=9 chars (letter and digit number only). Optional but recommended. We echo it back to help you match response with request. This is especially useful when you cancel in batch mode. | |

| orderId | String | Yes | 32 chars order id. You should set the value to be the orderId of the target order you want to cancel. |

| symbol | String | Yes | Symbol of the order to cancel |

| time | Long | Yes | milliseconds since UNIX epoch in UTC. We do not process request sent more than 30 seconds ago. |

| respInst | ENUM | ACK by default |

Response

respInst

Cancel Batch Orders

Cancel Batch Orders - Request Body

{

"orders":[

{

"id":"sampleRequestId1",

"orderId":"a177c2a8cfe1U0123456789eqntvwWsy",

"symbol":"BTC-PERP",

"time":1613900544076

},

{

"id":"sampleRequestId2",

"orderId":"a177c2a8cfe1U0123456789equestId2",

"symbol":"BTC-PERP",

"time":1613900544076

}

]

}

Cancel Batch Orders - Successful ACK Response (Status 200, code 0)

{

"code":0,

"data":{

"meta":{

"action":"batch-cancel-order",

"respInst":"ACK"

},

"orders":[

{

"id":"sampleRequestId1",

"orderId":"a177c2a8cfe1U0123456789eqntvwWsy",

"orderType":"",

"symbol":"BTC-PERP",

"timestamp":1613900544091

},

{

"id":"sampleRequestId2",

"orderId":"a177c2a8cfe1U0123456789equestId2",

"orderType":"",

"symbol":"BTC-PERP",

"timestamp":1613900544168

}

]

}

}

Cancel multiple orders in a batch. If any order(s) fails our basic check, the whole batch request will fail.

You may submit up to 10 orders to cancel at a time. Server will respond with error if you submit more than 10 orders.

HTTP Request

DELETE /<grp>/api/pro/v2/futures/order/batch

Prehash String

<timestamp>+v2/futures/order/batch

Request Parameters

| Name | Data Type | Description |

|---|---|---|

| orders | List | List of order items to cancel |

please refer to cancel order for order item definition

Cancel All Open Orders

Response

{

"code": 0

}

HTTP Request

DELETE /<grp>/api/pro/v2/futures/order/all

Prehash String

<timestamp>+v2/futures/order/all

Request Parameters

| PARAMETER | TYPE | REQUIRED | DESCRIPTION |

|---|---|---|---|

| symbol | String | No | the optional symbol filter |

List Open Orders

Response

{

"code": 0,

"data": [

{

"ac" : "FUTURES", // account category

"accountId" : "sample-futures-account-id", // account ID

"seqNum" : 14, // sequence number

"time" : 1605677683714, // order creation time

"orderId" : "sample-order-id", // order ID

"orderType" : "Limit", // order type

"side" : "Buy", // order side

"symbol" : "BTC-PERP", // contract symbol

"price" : "9500", // order price

"orderQty" : "0.1", // order quantity

"stopPrice" : "0", // stop price

"stopBy" : "market", // stop price trigger

"status" : "New", // order status

"lastExecTime": 1605677684479, // last execution time

"lastPx" : "0", // last filled price

"lastQty" : "0", // last filled quantity

"avgFilledPx" : "0", // average filled price of all fills

"cumFilledQty": "0", // cummulative filled quantity

"fee" : "0", // fee of the last fill

"cumFee" : "0", // cummulative fee

"feeAsset" : "USDT", // fee asset

"errorCode" : "" // error code

}

]

}

HTTP Request

GET /<grp>/api/pro/v2/futures/order/open

Prehash String

<timestamp>+v2/futures/order/open

List Current History Orders

Current History Orders - Request Body

{

"symbol":"BTC-PERP",

"n":20,

"executedOnly":true

}

Successful Response (Status 200, code 0)

{

"code":0,

"data":[

{

"ac":"FUTURES",

"accountId":"sampleFuturesAccountId",

"avgFilledPx":"58501",

"cumFee":"0.058501",

"cumFilledQty":"0.001",

"errorCode":"",

"execInst":"NULL_VAL",

"fee":"0.058501",

"feeAsset":"USDT",

"lastExecTime":1613992168196,

"lastPx":"58501",

"lastQty":"0.001",

"orderId":"a177c29e4064U0123456789dVeUxlVyA",

"orderQty":"0.001",

"orderType":"Limit",

"posStopLossPrice":"0",

"posStopLossTrigger":"market",

"posTakeProfitPrice":"0",

"posTakeProfitTrigger":"market",

"price" :"59027",

"seqNum":1041950,

"side":"Buy",

"status":"Filled",

"stopBy":"market",

"stopPrice":"0",

"symbol":"BTC-PERP",

"time":1613992168190

},

...

]

}

This API returns all current history orders for futures account.

HTTP Request

GET <account-group>/api/pro/v2/futures/order/hist/current

Prehash String

<timestamp>+v2/futures/order/hist/current

Request Parameters

| Name | Type | Required | Description |

|---|---|---|---|

| symbol | String | No | symbol filter, e.g. "BTC-PERP" |

| n | Int | No | maximum number of orders to be included in the response |

| executedOnly | Boolean | No | if True, include orders with non-zero filled quantities only. |

Response

Return a list of history orders in "data" field.

Query Order By ID

Query order with single order id - Request Body

{

"orderId":"a177c29e4064U0123456789dVeUxlVyA"

}

Successful Response (Status 200, code 0)

{

"code" : 0,

"accountId": "sampleFuturesAccountId",

"ac" : "FUTURES",

"data": {

"ac" : "FUTURES",

"accountId" : "sampleFuturesAccountId",

"avgFilledPx" : "0",

"cumFee" : "0",

"cumFilledQty" : "0",

"errorCode" : "",

"execInst" : "NULL_VAL",

"fee" : "0",

"feeAsset" : "USDT",

"lastExecTime" : 1613877923408,

"lastPx" : "0",

"lastQty" : "0",

"orderId" : "a177c29e4064U0123456789dVeUxlVyA",

"orderQty" : "0.1",

"orderType" : "Limit",

"posStopLossPrice" : "0",

"posStopLossTrigger" : "None",

"posTakeProfitPrice" : "0",

"posTakeProfitTrigger": "None",

"price" : "34000",

"seqNum" : 18586710,

"side" : "Buy",

"status" : "New",

"stopBy" : "",

"stopPrice" : "0",

"symbol" : "BTC-PERP",

"time" : 1613877922641

}

}

Query Order with multiple order ids - Request Body

{

"orderId":"a177c29e4064U0123456789dVeUxlVyA,a177c29e4064U0123456789dVeUxlVyB"

}

Successful Response (Status 200, code 0)

{

"code" : 0,

"accountId": "sampleFuturesAccountId",

"ac" : "FUTURES",

"data": [

{

"ac" : "FUTURES",

"accountId" : "sampleFuturesAccountId",

"orderId" : "a177c29e4064U0123456789dVeUxlVyA",

...

},

{

"ac" : "FUTURES",

"accountId" : "sampleFuturesAccountId",

"orderId" : "a177c29e4064U0123456789dVeUxlVyB",

...

}

]

}

HTTP Request

GET /<grp>/api/pro/v2/futures/order/status

Prehash String

<timestamp>+v2/futures/order/status

Request Parameters

| PARAMETER | TYPE | REQUIRED | DESCRIPTION |

|---|---|---|---|

| orderId | String | Yes | a single order id, or multiple order ids separated by , |

The API will respond with a list of objects in the data field. Each object in the list contains information of a single order. There's one exception, if you use only a single orderId, the data field of the API response will be simplified to a single object. If you want the API to respond with a list of only one object in this case, add a comma (,) to the orderId.

Balance Snapshot And Update Detail

Here we provide rest API to get daily balance snapshot, and intraday balance and order fills update details. We recommend calling balance snapshot endpoint(futures/balance/snapshot) to get balance at the beginning of the day, and get the sequence number sn; then start to query balance or order fills update from futures/balance/history by setting parameter sn value to be sn + 1.

Please note we enforce rate limit 8 / minute. Data query for most recent 7 days is supported.

Futures Account Balance Snapshot

This API returns futures balance snapshot on daily basis.

HTTP Request

GET api/pro/data/v1/futures/balance/snapshot

Signature

You should sign the message in header as specified in Authenticate a RESTful Request section.

Prehash String

<timestamp>+data/v1/futures/balance/snapshot

Request Parameters

| Name | Type | Required | Value Range | Description |

|---|---|---|---|---|

| date | String |

Yes | YYYY-mm-dd |

balance date |

Response Content

| Name | Type | Description |

|---|---|---|

| meta | Json |

meta info. See detail below |

| collateralBalance | Json Array |

collateral balance info. See detail below |

| contractBalance | Json Array |

contract balance info. See detail below |

meta field provides some basic info about the balance snapshot data.

meta schema

| Name | Type | Description | Sample Response |

|---|---|---|---|

| ac | String |

account category | "futures |

| accountId | String |

accountId | |

| sn | Long |

sequence number | |

| balanceTime | Long |

balance snapshot time in milli seconds |

collateralBalance field provides array of ‘asset’ and ‘totalBalance’ for collateral balance.

collateralBalance schema

| Name | Type | Description | Sample Response |

|---|---|---|---|

| asset | String |

asset code | "USDT" |

| totalBalance | String |

current asset total balance | "1234.56" |

contractBalance field provides array of current contract positions infomation.

contractBalance schema

| Name | Type | Description | Sample Response |

|---|---|---|---|

| contract | String |

contract name | "USDT" |

| futuresAssetBalance | String |

current contract position | "1234.56" |

| isolatedMargin | String |

Isolated margin | "134.56" |

| refCostBalance | String |

Reference cost | "34.56" |

Code Sample

Please refer to python code to query balance snapshot

Futures Order and Balance Detail

This API is for intraday balance change detail from balance event and order fillss.

HTTP Request

GET api/pro/data/v1/futures/balance/history

Prehash String

<timestamp>+data/v1/futures/balance/history

Futures Account Balance Detail - Sample response

{

"balance": [

{

"data": [

{

"asset": "XPRTPC",

"curBalance": "-7.873230189",

"deltaQty": "0.004117158"

}

],

"eventType": "Fundingpayment",

"sn": 18591022051,

"transactTime": 1634947227877

},

{

"data": [

{

"asset": "BTCPC",

"curBalance": "-307.654491085",

"deltaQty": "10.673854479"

},

{

"asset": "USDT",

"curBalance": "149.493187792",

"deltaQty": "10.673854479"

}

],

"eventType": "Futuressettlement",

"sn": 18590550015,

"transactTime": 1634913817331

}

],

"meta": {

"ac": "futures",

"accountId": "futfi7p9j312936d2hkjJpAahWyb4RCJ"

},

"order": [

{

"data": [

{

"asset": "PORTP",

"curBalance": "1",

"dataType": "trade",

"deltaQty": "1"

},

{

"asset": "PORTPC",

"curBalance": "-6.213726",

"dataType": "trade",

"deltaQty": "-6.21"

},

{

"asset": "PORTPC",

"curBalance": "-6.213726",

"dataType": "fee",

"deltaQty": "-0.003726"

}

],

"liquidityInd": "RemovedLiquidity",

"orderId": "r17ca5840c64U7684578612bportL84r",

"orderType": "Market",

"side": "Buy",

"sn": 18589783182,

"transactTime": 1634864467246

}

]

}

Request Parameters

| Name | Type | Required | Value Range | Description |

|---|---|---|---|---|

| sn | Long |

Yes | start from snapshot sn |

Start sn |

| limit | Int |

No | 1 to 500 | Number of records. max 500 |

Response Content

| Name | Type | Description |

|---|---|---|

| meta | Json |

meta info. See detail below |

| order | Json Array |

order info. See detail below |

| balance | Json Array |

balance info. See detail below |

Meta

meta field provides some basic info.

meta schema

| Name | Type | Description | Sample Response |

|---|---|---|---|

| ac | String |

account category | "cash", "margin", "futures |

| accountId | String |

accountId |

Order

order field provides an array of asset balance detail from order fill event.

order schema

| Name | Type | Description | Sample Response |

|---|---|---|---|

| liquidityInd | String |

liquidity indicator | RemovedLiquidity for taker order, AddedLiquidity for maker order, or NULL_VAL |

| orderId | String |

orderId | order Id |

| orderType | String |

order type | market, limit |

| side | String |

order side | buy, sell |

| sn | Long |

sequence number | unique and increasing sequence number |

| transactTime | Long |

transactTime in milli seconds | |

| data | Json Array |

list of order info json objects | see detail below |

order balance detail by asset

data schema

| Name | Type | Description | Sample Response |

|---|---|---|---|

| asset | String |

asset code | "USDT" |

| curBalance | String |

asset balance after this transaction | "1234.56" |

| dataType | String |

trade for trading asset; fee for fee balance asset |

trade, fee |

| deltaQty | String |

balance change in this transaction | 100 |

Balance

balance field provides an array of asset balance detail due to balance event.

balance schema

| Name | Type | Description | Sample Response |

|---|---|---|---|

| eventType | String |

balance event type | deposit, withdrawal |

| sn | Long |

sequence number | |

| transactTime | Long |

transactTime in milli seconds | |

| data | Json Array |

list of balance info json objects | see detail below |

data schema

| Name | Type | Description | Sample Response |

|---|---|---|---|

| asset | String |

asset code | "USDT" |

| curBalance | String |

asset balance after this transaction | "1234.56" |

| deltaQty | String |

balance change in this transaction | 100 |

Code Sample

Please refer to python code to query order and balance detail

WebSocket

How to Connect

Base endpoints:

Testnet:

- Public endpoint:

wss://api-test.ascendex-sandbox.com:443/api/pro/v2/stream - Private endpoint:

wss://api-test.ascendex-sandbox.com:443/<grp>/api/pro/v2/stream

- Public endpoint:

Mainnet:

- Public endpoint:

wss://ascendex.com:443/api/pro/v2/stream - Private endpoint:

wss://ascendex.com:443/<grp>/api/pro/v2/streamYou can only authenticate a WebSocket session via a private endpoint.

- Public endpoint:

WebSocket Authentication

You must authenticate the websocket session in order to recieve private data and send account specific requests (e.g. placing new orders).

You have two options to authenticate a websocket session.

- by adding authentication data in the request header when connecting to websocket.

- by sending an

op:authmessage to the server after you have connected to websocket.

Once you successfully connect to the websocket, you will receive a connected message:

- for authenticated websocket session:

{"m":"connected","type":"auth"} - for unauthenticated websocket session:

{"m":"connected","type":"unauth"}

If the session is disconnected for some reason, you will receive a disconnected message:

{"m":"disconnected","code":100005,"reason":"INVALID_WS_REQUEST_DATA","info":"Session is disconnected due to missing pong message from the client"}

Method 1 - WebSocket Authentication with Request Headers

Authenticate with Headers

# # Install wscat from Node.js if you haven't

# npm install -g wscat

APIPATH=v2/stream

APIKEY=BclE7dBGbS1AP3VnOuq6s8fJH0fWbH7r

SECRET=fAZcQRUMxj3eX3DreIjFcPiJ9UR3ZTdgIw8mxddvtcDxLoXvdbXJuFQYadUUsF7q

TIMESTAMP=`date +%s%N | cut -c -13`

MESSAGE=$TIMESTAMP+$APIPATH

SIGNATURE=`echo -n $MESSAGE | openssl dgst -sha256 -hmac $SECRET -binary | base64`

wscat -H "x-auth-key: $APIKEY" \

-H "x-auth-signature: $SIGNATURE" \

-H "x-auth-timestamp: $TIMESTAMP" \

-c wss://api-test.ascendex-sandbox.com:443/api/pro/v2/stream -w 1 -x '{"op":"sub", "id": "abc123", "ch": "order:cshQtyfq8XLAA9kcf19h8bXHbAwwoqDo:ASD/USDT"}'

This is similar to the way you authenticate any RESTful request. You need to add the following header fields to the connection request:

x-auth-keyx-auth-timestampx-auth-signature

The server will then check if the data is correctly signed before upgrading the connection protocol to WebSocket.

Note that if you specify these header fields, the server will reject the websocket connection request if authentication fails.

Method 2 - WebSocket Authentication by Sending the Auth Message

Authenticate by Sending the

authMessage

# # Install wscat from Node.js if you haven't

# npm install -g wscat

APIPATH=v2/stream

APIKEY=BclE7dBGbS1AP3VnOuq6s8fJH0fWbH7r

SECRET=fAZcQRUMxj3eX3DreIjFcPiJ9UR3ZTdgIw8mxddvtcDxLoXvdbXJuFQYadUUsF7q

TIMESTAMP=`date +%s%N | cut -c -13`

MESSAGE=$TIMESTAMP+$APIPATH

SIGNATURE=`echo -n $MESSAGE | openssl dgst -sha256 -hmac $SECRET -binary | base64`

wscat -c wss://api-test.ascendex-sandbox.com:443/1/api/pro/v2/stream -w 1 -x "{\"op\":\"auth\", \"id\": \"abc123\", \"t\": $TIMESTAMP, "key": \"$APIKEY\", \"sig\": \"$SIGNATURE\"}"

You can also authenticate a live websocket session by sending an op:auth message to the server.

| Name | Type | Required | Description |

|---|---|---|---|

op |

String |

Yes | "auth" |

id |

String |

No | optional id field, you may safely skip it |

t |

Long |

Yes | UTC timestamp in milliseconds, use this timestamp to generate signature |

key |

String |

Yes | your api key |

sig |

String |

Yes | the signature is generated by signing "<timestamp>+v2/stream" |

More comprehensive examples can be found at:

- Python demo for websocket auth

Authentication Response

Auth success message

{

"m": "auth",

"id": "abc123",

"code": 0

}

Auth error message

{

"m":"auth",

"id": "abc123",

"code": 200006,

"err": "Unable to find User Account Data"

}

You will receive a message for authentication result after you send authentication request.

| Field | Type | Description |

|---|---|---|

m |

String |

"auth" |

id |

String |

echo back the id if you provide one in the request |

code |

Long |

Any code other than 0 indicate an error in authentication |

err |

Optional[String] |

Provide detailed error message if code is not 0 |

Keep the Connection Alive

In order to keep the websocket connection alive, you have two options, detailed below.

Method 1: Responding to Server's ping messages

Method 1. keep the connection alive by responding to Server pushed ping message

<<< { "m": "ping", "hp": 3 } # Server pushed ping message

>>> { "op": "pong" } # Client responds with pong

If the server doesn't receive any client message after a while, it will send a ping message to the client. Once the ping message is received,

the client should promptly send a pong message to the server. If you missed two consecutive ping messages, the session will be disconnected.

Server Ping Message Schema

| Name | Type | Description |

|---|---|---|

| op | String | ping |

| hp | Int | health point: when this value decreases to 0, the session will be disconnected. |

Method 2: Sending ping messages to Server

Method 2. keep the connection alive by sending ping message to the server

>>> { "op": "ping" } # Client initiated ping message (every 30 seconds)

<<< { "m":"pong", "code":0, "ts":1614164189, "hp": 2 } # Server responds to client ping

You can also send ping message to the server every 15 seconds to keep the connection alive. The server will stop sending ping message

for 30 seconds if a client initiated ping message is received.

Server Pong Message Schema

| Name | Type | Description |

|---|---|---|

| m | String | pong |

| code | Int | error code, for the pong mesage, the error code is always 0 (success) |

| ts | Long | server time in UTC miliseconds |

| hp | Int | health point: when this value decreases to 0, the session will be disconnected. |

Public Stream Data

Channel: Futures Pricing Data

Sample Futures Pricing Data Message

{

"m": "futures-pricing-data",

"con": [ // contracts

{

"s" : "BTC-PERP", // symbol

"t" : 1614814705716, // data time

"ip": "50702.8", // index price

"mp": "50652.3553", // mark price

"r" : "0.000565699", // funding rate

"oi": "90.7367", // open interest

"f" : 1614816000000 // next funding time

}

],

"col": [ // collateral assets

{

"a": "USDTR", // asset

"p": "1" // reference price (quote in USDT)

},

{

"a": "USDC",

"p": "0.99935"

},

{

"a": "ETH",

"p": "1582.505"

},

{

"a": "PAX",

"p": "0.9964"

},

{

"a": "BTC",

"p": "50621.795"

},

{

"a": "USDT",

"p": "1"

}

]

}

Subscribe to the Channel

{"op":"sub", "id":"sample-id", "ch":"futures-pricing-data"}

Channel: Level 1 Order Book Data (BBO)

Subscribe to

BTC-PERPquote stream

{ "op": "sub", "id": "abc123", "ch":"bbo:BTC-PERP" }

Unsubscribe to

BTC-PERPquote stream

{ "op": "unsub", "id": "abc123", "ch":"bbo:BTC-PERP" }

BBO Message

{

"m": "bbo",

"symbol": "BTC-PERP",

"data": {

"ts": 1573068442532,

"bid": [

"9309.11",

"0.0197172"

],

"ask": [

"9309.12",

"0.8851266"

]

}

}

You can subscribe to updates of best bid/offer data stream only. Once subscribed, you will receive BBO message whenever the price and/or size changes at the top of the order book.

Each BBO message contains price and size data for exactly one bid level and one ask level.

Channel: Level 2 Order Book Updates

Subscribe to

BTC-PERPdepth updates stream

{ "op": "sub", "id": "abc123", "ch":"depth:BTC-PERP" }

Unsubscribe to

BTC-PERPdepth updates stream

{ "op": "unsub", "id": "abc123", "ch":"depth:BTC-PERP" }

The Depth Message

{

"m": "depth",

"symbol": "BTC-PERP",

"data": {

"ts": 1573069021376,

"seqnum": 2097965,

"asks": [

[

"0.06844",

"10760"

]

],

"bids": [

[

"0.06777",

"562.4"

],

[

"0.05",

"221760.6"

]

]

}

}

If you want to keep track of the most recent order book snapshot in its entirety, the most efficient way is to subscribe to the depth channel.

Each depth message contains a bids list and an asks list in its data field. Each list contains a series of [price, size] pairs that

you can use to update the order book snapshot. In the message, price is always positive and size is always non-negative.

- if

sizeis positive and thepricedoesn't exist in the current order book, you should add a new level[price, size]. - if

sizeis positive and thepriceexists in the current order book, you should update the existing level to[price, size]. - if

sizeis zero, you should delete the level atprice.

See Orderbook Snapshot for code examples.

Channel: Market Trades

Subscribe to

BTC-PERPmarket trades stream

{ "op": "sub", "id": "abc123", "ch":"trades:BTC-PERP" }

Unsubscribe to

BTC-PERPmarket trades stream

{ "op": "unsub", "id": "abc123", "ch":"trades:BTC-PERP" }

Trade Message

{

"m": "trades",

"symbol": "BTC-PERP",

"data": [

{

"p": "0.068600",

"q": "100.000",

"ts": 1573069903254,

"bm": false,

"seqnum": 144115188077966308

}

]

}

The data field is a list containing one or more trade objects. The server may combine consecutive trades with the same price and bm

value into one aggregated item. Each trade object contains the following fields:

| Name | Type | Description |

|---|---|---|

| seqnum | Long | the sequence number of the trade record. seqnum is always increasing for each symbol, but may not be consecutive |

| p | String | the executed price expressed as a string |

| q | String | the aggregated traded amount expressed as string |

| ts | Long | the UTC timestamp in milliseconds of the first trade |

| bm | Boolean | if true, the buyer of the trade is the maker. |

Channel: Bar Data

Subscribe to

BTC-PERP1 minute bar stream

{ "op": "sub", "id": "abc123", "ch":"bar:1:BTC-PERP" }

Unsubscribe to

BTC-PERP1 minute bar stream

{ "op": "unsub", "id": "abc123", "ch":"bar:1:BTC-PERP" }

// Alternatively, you can unsubscribe all bar streams for BTC-PERP

{ "op": "unsub", "id": "abc123", "ch":"bar:*:BTC-PERP" }

// Or unsubscribe all 1 minute bar stream

{ "op": "unsub", "id": "abc123", "ch":"bar:1" }

// Or unsubscribe all bar stream

{ "op": "unsub", "id": "abc123", "ch":"bar" }

Bar Data Message

{

"m": "bar",

"s": "BTC-PERP",

"data": {

"i": "1",

"ts": 1575398940000,

"o": "0.04993",

"c": "0.04970",

"h": "0.04993",

"l": "0.04970",

"v": "8052"

}

}

The data field is a list containing one or more trade objects. The server may combine consecutive trades with the same price and bm

value into one aggregated item. Each trade object contains the following fields:

| Name | Type | Description |

|---|---|---|

| seqnum | Long | the sequence number of the trade record. seqnum is always increasing for each symbol, but may not be consecutive |

| p | String | the executed price expressed as a string |

| q | String | the aggregated traded amount expressed as string |

| ts | Long | the UTC timestamp in milliseconds of the first trade |

| bm | Boolean | if true, the buyer of the trade is the maker. |

Private Stream Data

Channel: Order

{

"m" : "futures-order",

"sn" : 127, // sequence number

"e" : "ExecutionReport", // event

"a" : "sample-futures-account-id", // account Id

"ac" : "FUTURES", // account category

"t" : 1606335352348, // last execution time

"ct" : 1606335351541, // order creation time

"orderId": "a176010c4957U68469127074abcd1234", // order Id

"sd" : "Buy", // side

"ot" : "Limit", // order type

"q" : "0.1", // order quantity (base asset)

"p" : "18000", // order price

"sp" : "0", // stop price

"spb" : "", // stop trigger

"s" : "BTC-PERP", // symbol

"st" : "New", // order status

"lp" : "0", // last filled price

"lq" : "0", // last filled quantity (base asset)

"ap" : "0", // average filled price

"cfq" : "0", // cummulative filled quantity (base asset)

"f" : "0", // commission fee of the current execution

"cf" : "0", // cumulative commission fee

"fa" : "USDT", // fee asset

"ei" : "NULL_VAL", // execution instruction

"err" : "" // error message

}

Subscribe to the Channel

{"op":"sub", "id":"sample-id", "ch":"futures-order"}

Channel: Account Update

{

"m" : "futures-account-update", // message

"e" : "ExecutionReport", // event type

"t" : 1612508562129, // server time (UTC time in milliseconds)

"acc" : "sample-futures-account-id", // account ID

"at" : "FUTURES", // account type

"sn" : 23128, // sequence number, strictly increasing for each account

"id" : "r177710001cbU3813942147C5kbFGOan", // request ID for this account update

"col": [

{

"a": "USDT", // asset code

"b": "1000000", // balance

"f": "1" // discount factor

}

],

"pos": [

{

"s" : "BTC-PERP", // symbol

"sd" : "LONG", // side

"pos" : "0.011", // position

"rc" : "-385.840455", // reference cost

"up" : "18.436008668", // unrealized pnl

"rp" : "0", // realized pnl

"aop" : "35041.363636363", // Average Opening Price

"boon": "0", // Buy Open Order Notional

"soon": "0", // Sell Open Order Notional

"mt" : "crossed", // margin type: isolated / cross

"iw" : "0", // isolated margin

"lev" : "10", // leverage

"tp" : "0", // take profit price (by position exit order)

"tpt" : "market", // take profit trigger (by position exit order)

"sl" : "0", // stop loss price (by position exit order)

"slt" : "market", // stop loss trigger (by position exit order)

}

]

}

Subscribe to the Channel

{"op":"sub", "id":"sample-id", "ch":"futures-account-update"}

WebSocket - Data Request

WS: Account Snapshot

Requesting Futures Account Snapshot

{

"op" : "req",

"id" : "abc123456",

"action": "futures-account-snapshot"

}

Futures Account Snapshot response

{

"m" : "futures-account-snapshot", // message

"id" : "abc123456", // echo back the request Id

"e" : "ClientRequest", // event name

"t" : 1613748277356, // server time in milliseconds (UTC)

"acc": "futH9N59hR0BMVEjHnBleHLn0mfUl5lo", // accountId

"ac" : "FUTURES", // account category

"sn" : 9982, // sequence number

"col":[ // collateral balances

{

"a": "ETH", // collateral asset code

"b": "500", // collateral balance

"f": "0.95" // discount factor

},

{

"a": "BTC",

"b": "100",

"f": "0.98"

},

{

"a": "USDT",

"b": "1000000",

"f": "1"

}

],

"pos":[ // contract positions

{

"s" : "BTC-PERP", // contract symbol

"sd" : "NULL_VAL", // side: LONG / SHORT / NULL_VAL

"pos" : "0", // position

"rc" : "0", // reference cost

"up" : "0", // unrealized pnl

"rp" : "0", // realized pnl

"aop" : "0", // average opening price

"mt" : "crossed", // margin type: isolated / cross

"boon": "0", // buy open order notional

"soon": "0", // sell open order notional

"lev" : "10", // leverage

"iw" : "0", // isolated margin

"tp" : "0", // take profit price (by position exit order)

"tpt" : "market", // take profit trigger (by position exit order)

"sl" : "0", // stop loss price (by position exit order)